The partial invoice refers only to a part of a good or service, in contrast to an A/R invoice, in which goods and/or services provided are recorded in their entirety. Particularly in the case of larger projects or longer-term service provision, issuing several partial invoices instead of a single outgoing invoice offers a number of advantages – both for the exhibitor and for the recipient of the invoice. They ensure clarity, make it easier for both sides to assign the invoice and serve as a service for the customer. Of course, it is not forbidden to specify further information on invoices for smaller amounts.

It helps them to record incoming payments correctly. The latter information is common, particularly for companies that send invoices and receive payments in large numbers. Identifier to be used when making payment.

#Define invoice vs receipt professional

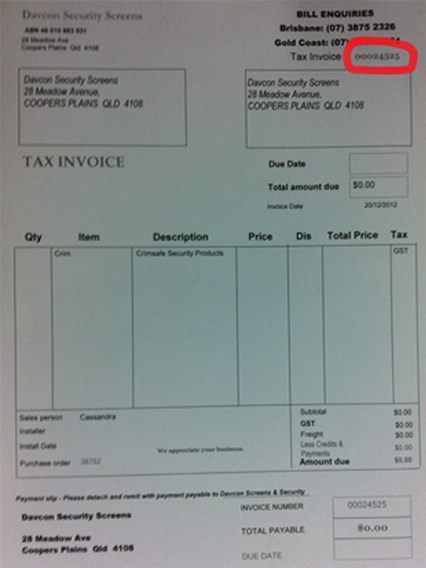

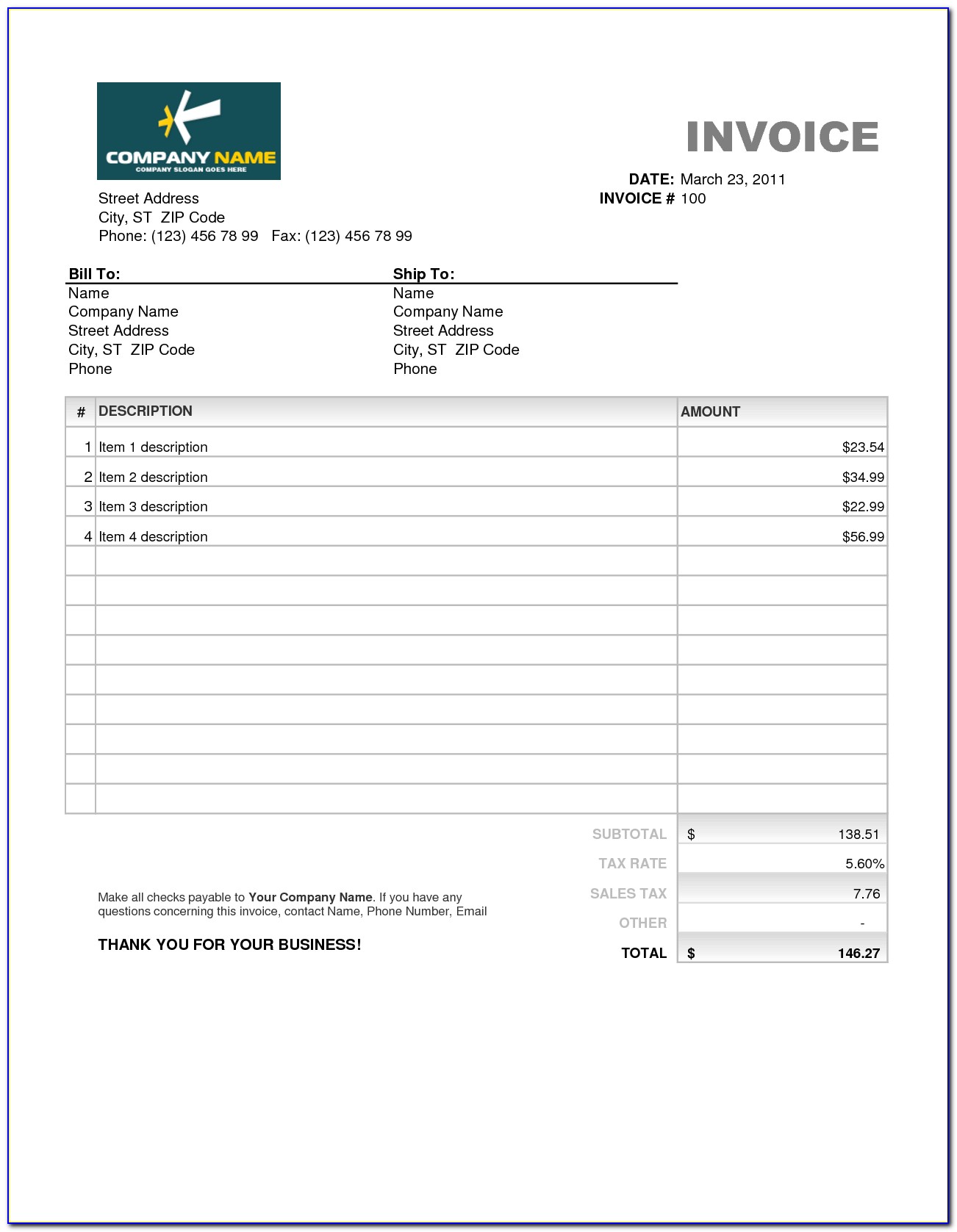

The description of the goods and services supplied (individually and broken down by quantity or volume)Ĭompanies registered in a professional register or association may be required to provide additional information, depending on their legal form:Īdditional information is also practical for commercial transactions and should be included in the A/R invoice.Name and address of the invoicing party.The mandatory data for these so-called small amount invoices include: Indications of previously agreed discounts, bonuses or rebates (if offered)įor smaller invoices, less data is required.Sales tax rates and amounts (if applicable).Net invoice amounts, broken down by sales tax rates.The quantity and description of the goods or services supplied (individually and broken down by quantity or volume).Time of delivery or period of service provision.Tax number or sales identification number.

Name and address of the invoice recipient.Name and address of the invoicing party (including the type of company, if applicable).For an A/R invoice to be legally binding, companies must provide certain information in the document.

0 kommentar(er)

0 kommentar(er)